|

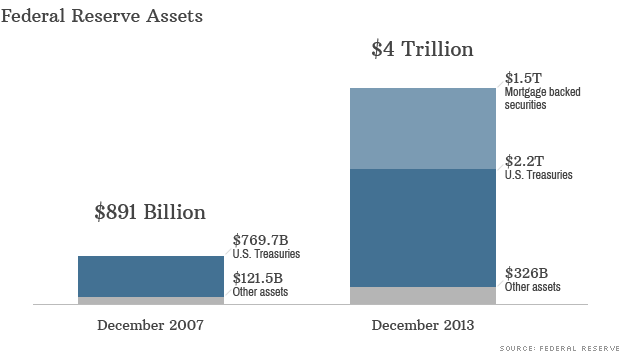

Fed's Assets Top $4 trillion

If there's one point Ben Bernanke wanted to hammer home on Wednesday, it's this: The Federal Reserve is still trying to stimulate the economy, even if that stimulus flows at a slightly slower pace. "We're certainly not giving up," Bernanke said, minutes after the Fed announced it would start reducing the amount of bonds it buys each month -- a process Wall Street had called "tapering." "While we are slowing asset purchases a bit, we expect the total balance sheet to be quite large and maintained at a large level for a long time," Bernanke added later. Tapering doesn't begin until January, and meanwhile the bond-buying continues at full strength. Just this week, the program pushed the Fed's portfolio over the $4 trillion mark. To be more exact, the Fed's assets now total $4,008,062,000,000 -- a new record high, according to a weekly report released by the central bank on Thursday afternoon. And it's going to keep climbing. Starting next month, the Fed plans to buy $75 billion in bonds, down from the $85 billion it has been buying every month since September of last year. If the economy progresses as hoped, they plan to continue gradually reducing the bond buys. But if anything, the sheer magnitude of the figure is just one more sign of how deeply the economic crisis hurt the U.S. economy. "The broader takeaway is, this is an illustration of how much monetary accommodation was needed to cushion the bursting of the housing and credit bubble," said Goldman Sachs Chief Economist Jan Hatzius. "It was a very painful and costly event -- and monetary policy has responded to that." How did the Fed pay for this? That's the unique and mysterious thing about the Fed. It can essentially create money out of thin air. Does the Fed need to sell all those assets? Not necessarily. When (or if) the economy eventually picks up steam, Federal Reserve officials have indicated they may allow many of the bonds to simply mature. So how will they eventually rein in all that money so the economy doesn't overheat? The Fed is testing a new tool that would allow it to pay banks and money market funds a higher interest rate to hold their money at the Fed overnight, rather than lending it out. Through this tool -- called an overnight fixed-rate full allotment reverse repo facility (we know, it's a tongue twister) -- the Fed can prevent excess money from sloshing around in the economy, without actually having to sell its bonds.

|

| © 2006 - 2022. All Rights Reserved. |