|

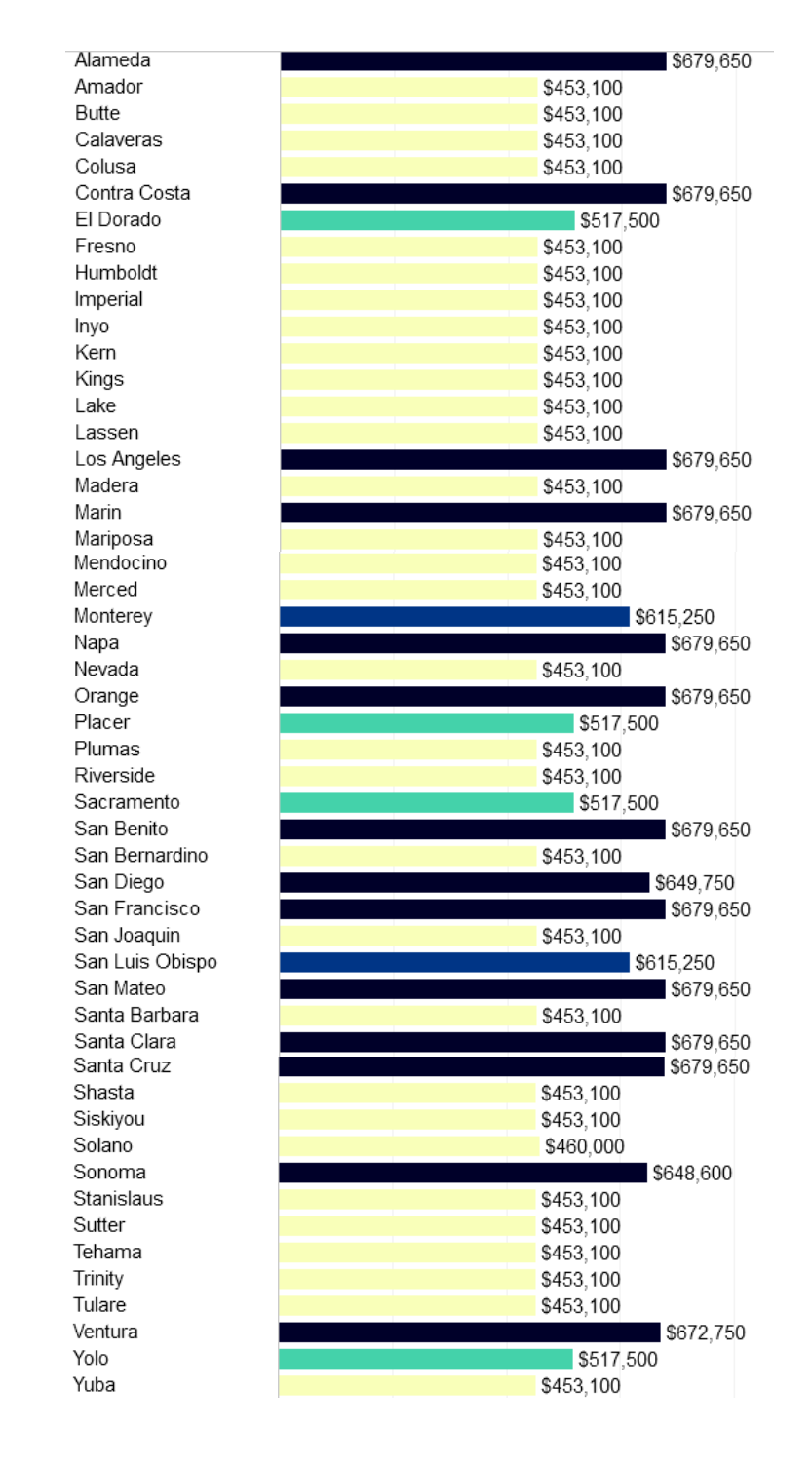

Fannie & Freddie Conforming Loan Limits Raised Up to $679,650 The 2018 Conforming Loan Limit in Most Areas is $453,100. The limit is higher in a handful of high-cost counties nationwide, up to a maximum of $679,650. Nationwide, the 2018 conforming loan limit for most counties increased by $29,000 (6.8 percent), to $453,100. The Federal Housing Finance Agency (FHFA) recently bumped 2018 conforming loan limits – the maximum loan amount that federally backed mortgage insurers Fannie Mae and Freddie Mac will guarantee. Loans above these limits – known as jumbo mortgages – must be insured by private mortgage insurers, and typically cost more. Nationwide, the 2018 conforming loan limit for most counties increased by $29,000 (6.8 percent), to $453,100. The increase is roughly in line with current annual U.S. home value appreciation as measured by the Zillow Home Value Index, which stood at 6.5 percent as of October (the most recent month for which data is available). In 138 FHFA-designated “high-cost counties” nationwide, the conforming loan limit is higher than the national baseline. Three Washington state counties in the Seattle area – King, Pierce and Snohomish counties – got the biggest increases in the local conforming loan limit, bumped by $74,750 from 2017 levels to $667,000 in 2018. California’s Sonoma County and Boulder County in Colorado also received large bumps in the local conforming loan limit of around $50,000. Hood River County in Oregon – just east of Portland – was designated as a “high-cost county” for the first time.

|

| © 2006 - 2022. All Rights Reserved. |