|

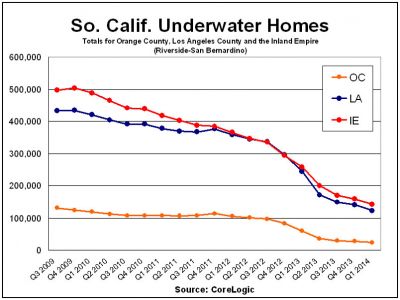

10% of SoCal Homeowners Still Underwater Despite Increase in Home Prices From: Doctorhousingbubble.com You would think that the recent rise in home prices across Southern California would be enough to bring most homeowners into a positive equity position. However, we still have 1 out of 10 homeowners in a negative equity position. The total number of homes underwater in SoCal is estimated to be at 288,000 according to CoreLogic. This is a far cry from the 1.1 million underwater homes going back to 2009. Since that time many foreclosures have occurred and many homes have now shifted into the hands of investors. 288,000 is a large number of homes especially in a market with limited inventory. Now that we are entering into the slower fall selling season, you will likely see inventory pullback and buying demand slow down. Investor demand has pulled back dramatically already. There still seems to be this amnesia as to what happened only a few years ago. Millions of homeowners lost out in the supposedly safe investment vehicle of housing. Why? Because they took on too much debt and paid too much for a property. As prices soared in the last year, we are starting to see a deeper questioning of current values now that investors are pulling back and foreclosure resales make up a small portion of the market. Regular buyers did not push this market up. It was investors. Many regular households have been pushed into renting. California has been boom and bust for a generation. Take a look at price increases for the LA and OC metro areas:

This is a boom and bust model. Ideally what you would see is a steady year-over-year increase tracking inflation versus these massive peaks and valleys. You can already see that year-over-year increases are reversing and slowing down. Will prices dip? If they do, you will have the same circuitous process that happened in the early 1990s and the bust of the latest housing bubble. The argument that hits in SoCal is that home prices only go up. That is clearly not the case as the chart above highlights. Also, we still have a large number of current homeowners that owe more on their property than it is currently worth:

It is hard to believe that only in 2009, we had 1.1 million underwater homeowners in SoCal alone. That number has fallen dramatically. Why? Because we had a ton of foreclosures and short sales! In other words people got massively burned in an area that is supposedly immune to all sorts of economic cycles. So much for prices only going up. Keep in mind that many areas are now seeing home prices reaching levels that are very close to the peak that brought down the market the last time. What we are seeing in the market today is the following: -Buyers reluctant to pay current prices -Some sellers pulling properties off market because of seasonal factors -Foreclosures making up a small portion of resales California real estate seems to be destined to booms and busts. We just had a boom. Why are we to expect that for the first time in a generation, that suddenly, people are going to prudent and manage their finances wisely? To the contrary, people will live paycheck to paycheck in good times and in bad times. It is the California way. I continue to be amazed by baby boomers scratching to get by yet live in a million dollar sarcophagus. Given that 2.3 million adults now live with their parents, it does make sense however. Many are tied down with kids that simply cannot buy (or even rent) a property in the current market. So when the next economic hiccup will hit, it will expose those living paycheck to paycheck once again and the amnesia will repeat again. Many Californians have most of their net worth in their home. Yet a home does not throw off income (a rental does and that is the view many investors have taken). In fact, a home even with a paid off mortgage will require taxes, insurance, and maintenance each and every year. The purpose of retirement planning is to have income being sent your way, not out of your checking account. People seem to forget that you need to sell to unlock that equity. Many today cannot because they are underwater, even with a manic 2013. Some seem to be surprised that the summer was so weak and now we are entering the slower fall season. What do you expect when household fundamentals are simply not improving and the big player investors are now pulling back? Then again, people love being in debt and spending every penny they got.

|

| © 2006 - 2022. All Rights Reserved. |