|

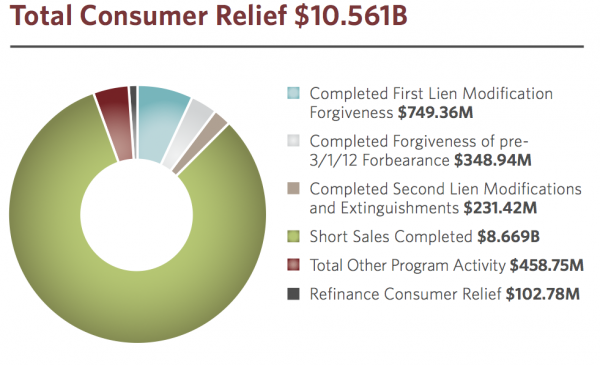

Banks Provide $10.5 Billion Under AG Foreclosure Settlement The five largest mortgage servicers provided $10.5 billion to struggling homeowners for short sale debt forgiveness or principle loan reductions under the Department of Justice foreclosure settlement signed in March, according to the first progress report from monitor Joseph Smith. The $10.5 billion is a gross dollar amount and is not used to determine progress toward the $20 billion in relief committed to under the agreement. The banks get credit for helping homeowners avoid foreclosure through short sales or modifications. Different forms of relief receive different dollar amounts of credit. The report was issued by the Office of Mortgage Settlement Oversight, which is monitoring the $25 billion settlement with five banks -- Bank of America, Wells Fargo, Citibank, JP Morgan Chase, and Ally Financial. Of the assistance given through June 30, nearly $8.7 billion was in short sales, an overwhelmingly majority. Through a short sale, servicers waive the difference for what the home sold for and the unpaid principal balance on the mortgage. The next closest was $750 million in completed first-lien modification forgiveness for about 7,000 borrowers, with an average debt forgiveness of $107,000. Roughly 28,000 borrowers were in trial modifications for a principal reduction under the settlement, according to the monitor report. These active trials and the roughly $3 billion in additional relief to the reported $10.5 billion will be reflected in future reports and credited to the settlement when the mods are made permanent. BofA, for example, sent out 200,000 letters to borrowers who may have been potentially eligible for the write downs. But there is a cap on how much lenders can claim for short sales under the settlement deal, explained Shaun Donovan, secretary of the U.S. Department of Housing and Urban Development. Once banks reach their limits, they won't be able to claim anything more under the settlement. For a full breakdown of the relief given click the chart below.

Nearly 138,000 borrowers received some form of assistance in first five months of the program, either through short sale, modification, refinance, forbearance or other activity. BofA approved short sale for more than 50,000 borrowers totaling $4.9 billion dollars, the most of any other servicer. Chase came in second with $2.4 billion. Conspicuously lacking so far is anywhere near the $17 billion in principal reduction that lenders have promised under the deal. Lenders had said they would reduce the balance owed on mortgages for those who either owed far more on their homes than they were worth or who were behind on payments. The aim was to get the mortgage balance closer to the home's value, reduce the borrower's monthly payments and help them avoid foreclosure. Of the five lenders, Chase had completed the most modifications on first mortgages, $376 million worth. In contrast, Bank of America submitted no modification claims on first mortgages between March and June. However, it has started nearly $2 billion trial modifications that were moving through the trial process, more than any other bank. In second place for trial mods was Chase with $1.2 billion that were offered or approved. Those numbers should increase dramatically, however, since many modifications have yet to be counted. Donovan said they structured the settlement to require borrowers to keep up payments during a 90-day trial period before they're considered successful modifications. At that point, the monitor will credit the cost of the modification to the bank's account. Currently, more than 28,000 trial modifications of all types are in progress, said Donovan. He said an additional $3 billion worth of modifications should be included in the first official report to be released in November. "The banks are heading in the right direction," said Donovan. "This will deliver real relief to consumers." As for the standards outlined in the settlement, Smith said the servicers implemented 56 of them, including single points of contact anti-blight policies. "More hard work remains as the banks work to meet their obligations. My colleagues and I look forward to that work and to keeping policymakers and the public informed of our progress," Smith said.

|

| © 2006 - 2022. All Rights Reserved. |