|

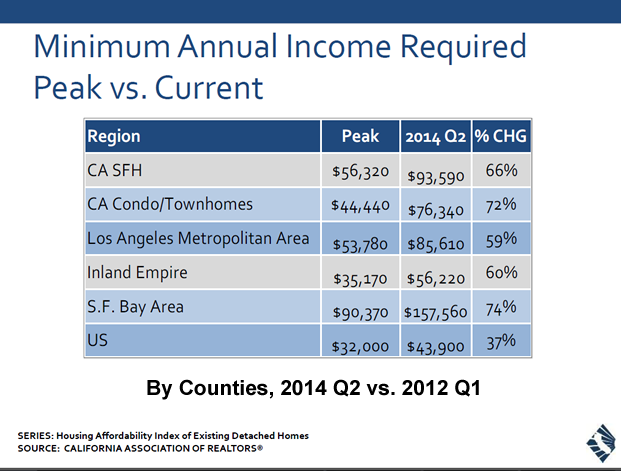

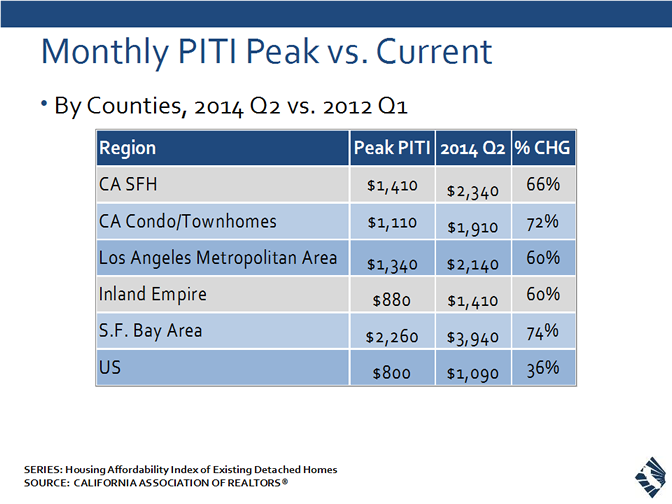

C.A.R. - 2nd Qtr Housing Affordability Declines Statewide and in 19 of 26 California Counties LOS ANGELES (Aug. 13) – Lower interest rates in the second quarter of 2014 failed to offset continued home price increases. The percentage of home buyers who could afford to purchase a median-priced, existing single-family home in California fell from 33 percent in the first quarter of 2014 to 30 percent in second-quarter 2014 and was down from 36 percent in second-quarter 2013, according to C.A.R.’s Traditional Housing Affordability Index (HAI). C.A.R.’s HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. C.A.R. also reports affordability indices for regions and select counties within the state. The Index is considered the most fundamental measure of housing well-being for home buyers in the state. Home buyers needed to earn a minimum annual income of $93,590 to qualify for the purchase of a $457,140 statewide median-priced, existing single-family home in the second quarter of 2014. The monthly payment, including taxes and insurance on a 30-year fixed-rate loan, would be $2,340, assuming a 20 percent down payment and an effective composite interest rate of 4.32 percent. The effective composite interest rate in first-quarter 2014 was 4.46 percent and 3.64 percent in the second quarter of 2012. The median home price was $416,720 in first-quarter 2014, and an annual income of $86,420 was needed to purchase a home at that price. Key points from the second quarter Housing Affordability report include: •During the second quarter of 2014, the three most affordable counties in California were Kings (64 percent), San Bernardino (58 percent), and Merced (57 percent). •The least affordable counties in California were San Francisco, San Mateo, and Marin (all at 14 percent). •Housing affordability has dropped 26 percent since first-quarter 2012, when housing peaked as the most affordable in California. •With home prices increasing at double-digit rates throughout 2013 and interest rates higher than levels observed in early 2013, both the monthly payment, including taxes and insurance (PITI), and minimum income required to purchase a home, shot up by more than 66 percent at the statewide level.

|

| © 2006 - 2022. All Rights Reserved. |