|

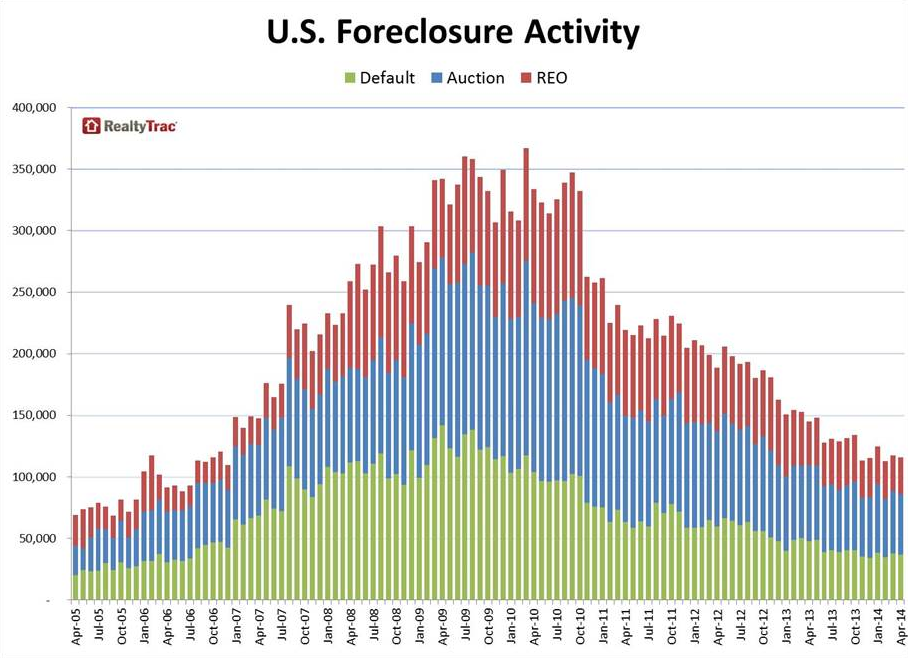

Foreclosure Activity Continues to Wind Down RealtyTrac released its U.S. Foreclosure Market Report™ for April 2014 today showing foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 115,830 U.S. properties in April, a 1% decrease from the previous month and down 20% from April 2013. The report also shows one in every 1,137 U.S. housing units with a foreclosure filing during the month. Despite the decrease in overall foreclosure activity, bank repossessions in April increased 4% from the previous month, but were down 14% from a year ago. There were a total of 30,056 bank repossessions nationwide in April. Bank repossessions increased from the previous month in 26 states and were up from a year ago in 16 states, including New York (142% increase), Oregon (91% increase), New Jersey (58% increase), Illinois (55% increase), Indiana (52% increase), Maryland (45% increase), Connecticut (44% increase), California (27% increase), and Nevada (15% increase). Scheduled foreclosure auctions down nationally, up from year ago in 17 states A total of 49,239 U.S. properties were scheduled for a future foreclosure auction in April, down 3% from the previous month and down 21% from a year ago — the 41st consecutive month where scheduled foreclosure auctions decreased annually. Scheduled auctions increased from the previous month in 22 states and were up from a year ago in 17 states, including Oregon (up 229%), Utah (up 101%), Colorado (up 87%), New Jersey (up 73%), Alabama (up 25%), New York (up 25%), and Florida (up 8%). Foreclosure starts down nationally, up from a year ago in 16 states A total of 54,613 U.S. properties started the foreclosure process in April, down 2% from the previous month and down 22% from a year ago — the 21st consecutive month where U.S. foreclosure starts decreased annually. Foreclosure starts, which are scheduled auctions in some states, increased from the previous month in 26 states and were up from a year ago in 16 states.

|

| © 2006 - 2022. All Rights Reserved. |