|

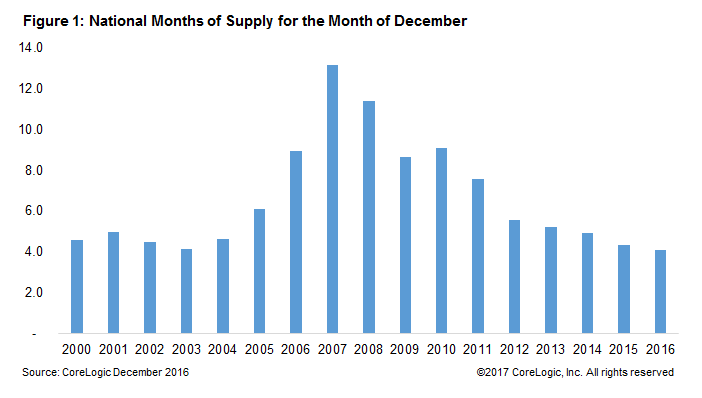

National Supply of Homes for Sale Has Fallen to Early 2000s Level December is the holiday season for many people who take time off from work, travel and spend time with family. For many business, it’s the slow time of the year. However, with interest rates rising, home buyers this past December were in a hurry to lock in a mortgage rate. The housing market became so tight in December 2016 that the months of supply fell to 4.1 months, the lowest for a December since 2000. That means that it would only take four months to sell all the existing houses listed for sale at the December sales pace. The December 2016 supply was about one quarter of the peak level of 16.2 months in January 2008, but higher than the trough of 3.5 months in June 2000.

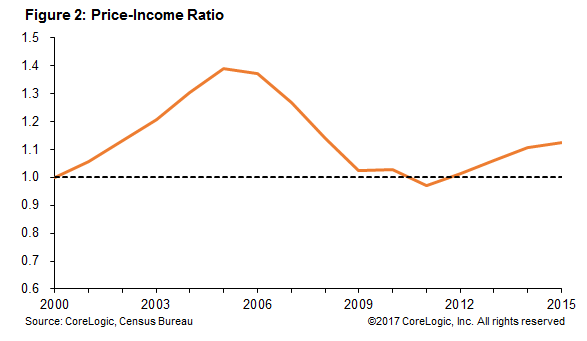

In recent years, the combination of a tight inventory and rising demand has fueled strong home-price gains that have outpaced household income growth, causing affordability constraints. Figure 2 shows the ratio of median home price from CoreLogic and median income from the Bureau of the Census, with the ratio set to 1 in 2000. When the ratio rises above 1, home prices are increasing faster than incomes. Only in 2011, three year after the financial crisis, did the price-to-income ratio go slightly below 1, and it has been rising since then. Home-price growth has been especially strong for lower-price homes. According to my colleague Molly Boesel’s latest Home Price Index blog, the low-price tier increased 10 percent year over year in January 2017[1].

|

| © 2006 - 2022. All Rights Reserved. |