|

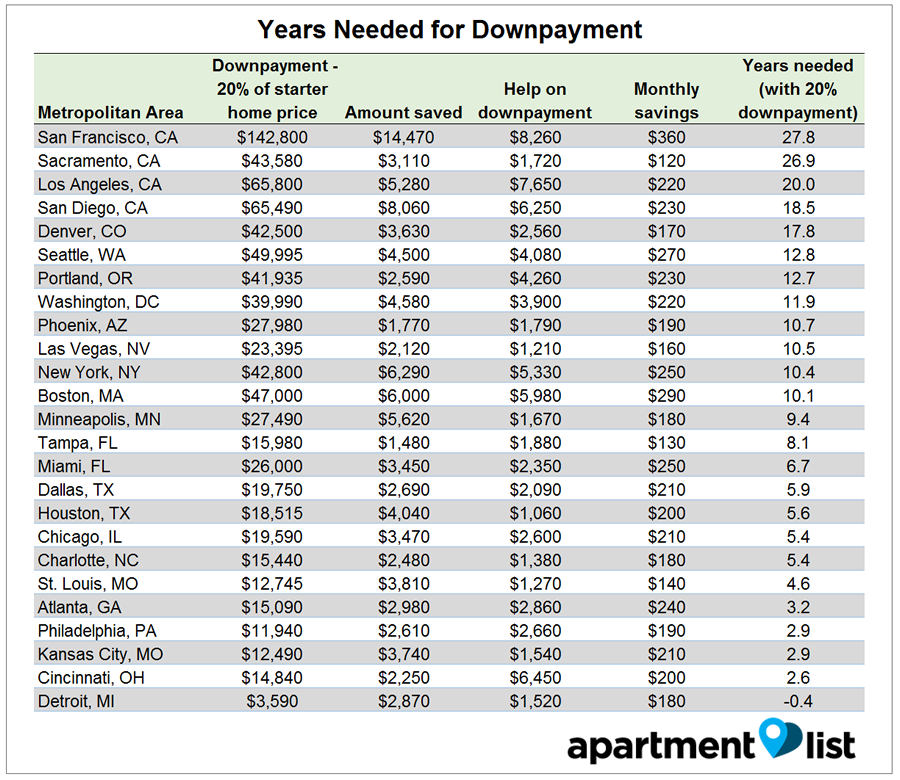

The Affordability Crisis: What Happens When Millennials Can’t Afford to Buy Homes? Apartment List recently conducted a survey of more than 30,000 renters across the United States, asking questions about their plans for homeownership, affordability, and savings for a down payment. ...millennial renters in expensive metropolitan areas significantly underestimate the amount they need to save for a down payment, in many cases by 50% or more. Using data on starter home prices and millennials’ average savings rates currently, we estimate that many renters will need a decade or more before they can afford a 20% downpayment on a home. The homeownership rate is especially low among millennials, and continues to decline each quarter. There are many factors affecting this trend – rising rents, student loans, and delayed marriages, for example – making it difficult to forecast trends in millennial homeownership. Our research suggests that affordability is the biggest barrier to homeownership, with 77% of millennials stating that it is the reason why they are unable to purchase a home. Millennials in expensive metros vastly underestimate down payment costs. More than 40% of millennials are not saving anything for a down payment In order to determine how long millennial renters will need to save for a down payment, we also asked them the following questions: Looking at the data, 37% of millennial renters have not saved anything for a down payment, and more than 41% are not saving each month. Even among older millennials, the picture is not much better: more than 70% are saving less than $200 each month, even in expensive cities like Boston or Los Angeles. Interestingly, 74% of millennials do not expect to receive any help for their down payment; only 6% expect to receive $10,000 or more in financial support. What happens when millennials can’t afford to buy? The past decade has seen large numbers of millennials move to San Francisco, Denver, Seattle, and other expensive cities along or near the coast, driving up rents and home prices. Worryingly, many do not seem to realize their financial predicament – three in four renters plan to purchase a home within the next five years, but their savings trajectories suggest that they may need a decade or more to afford it. Fortunately, the picture looks better in other parts of the country, which means that homeownership may still be within reach for those living in these parts, or who are willing to relocate out of the pricey cities.

Many millennials need a decade or more to save for a 20% down payment

The Apartment List renter survey was conducted from November 2015 to February 2016, and sent to renters searching for an apartment on our website. A full copy of the survey is available upon request.

|

| © 2006 - 2022. All Rights Reserved. |