|

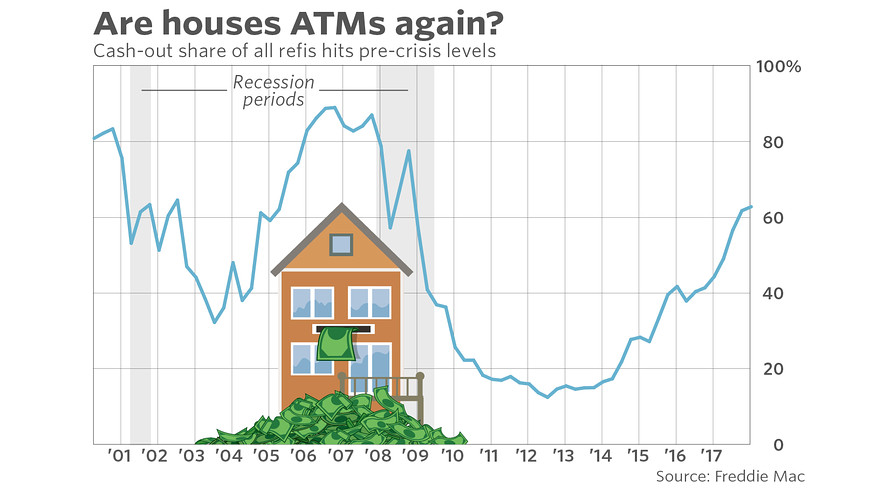

The Housing ATM is Back – Cash-out Share of All Refis Hits Pre-Crisis Levels People are once again using their homes like ATM machines. And of course contrary to anecdotal evidence, we have actual data on this:

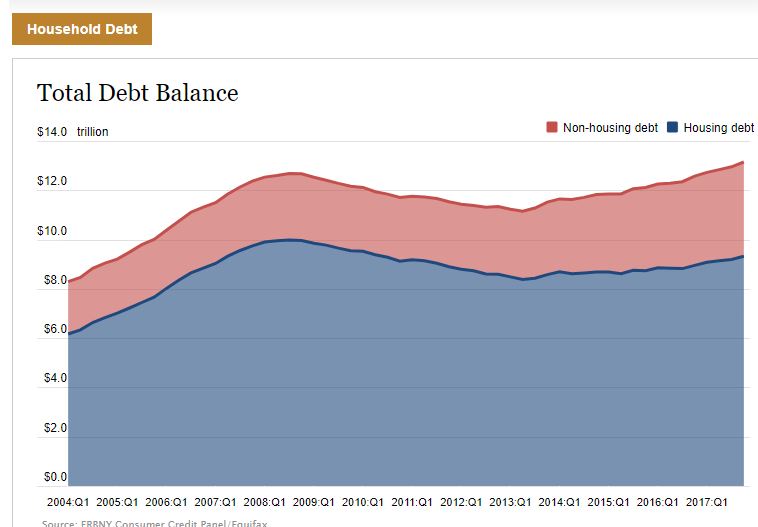

By doing cash-out refis you are essentially locking in the current valuation of a home and this gives you little buffer should there be a correction (of course this will never happen according to some). Your debt load increases but this trend signifies something deeper. The delusion is running deep. You can look at crypto-currencies, startup companies, and even housing and we are in overvalued territory. This idea that people are careful with their mortgages and their monthly payments is nonsense. A majority of people max out their lifestyle and are living on the edge when it comes to servicing their payments. They have mega mortgages, big car leases, kids in daycare, and their monthly bill is obscene. All you need is a minor correction and the house of cards will collapse. Tapping equity out of your house simply prolongs your obligations and assumes the good times will go on indefinitely. This is largely symptomatic of a bigger issue here and that is people are still cash strapped. The amount of debt circulating in the economy is relatively high:

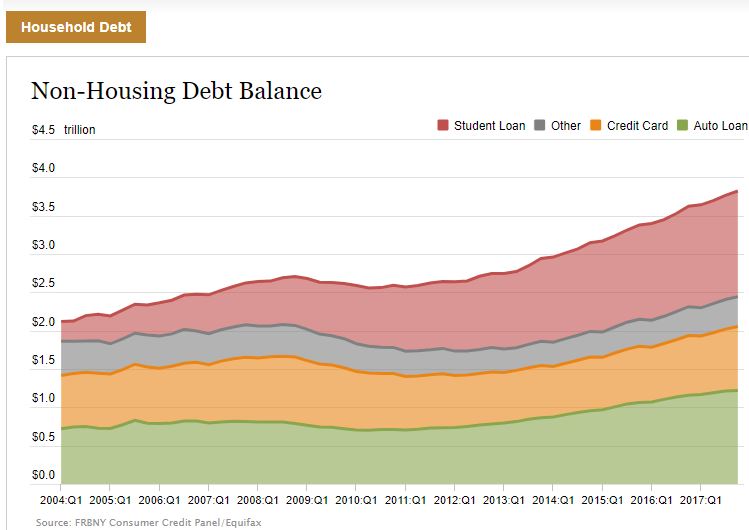

Housing related debt is creeping back up but non-housing debt is in deep record territory:

What this shows is that people truly believe current valuations are solid and that prices will only go higher. The same mentality hit in the last bubble when people were tapping equity out of their homes. Of course this time it is more “sophisticated” and we won’t repeat the past.

From Dr. Housing Bubble’s Blog

|

| © 2006 - 2022. All Rights Reserved. |