Go Back

Unlisted 'Shadow' Inventory of 1.8 Million Homes Looms Over Housing Market

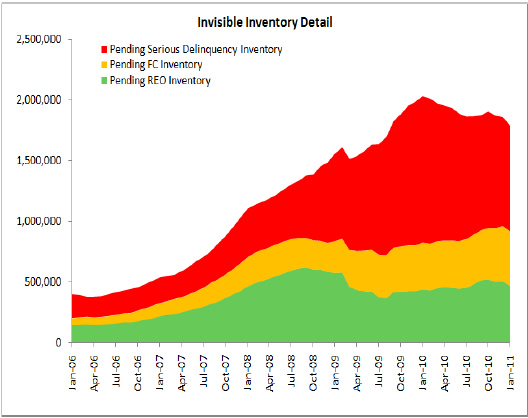

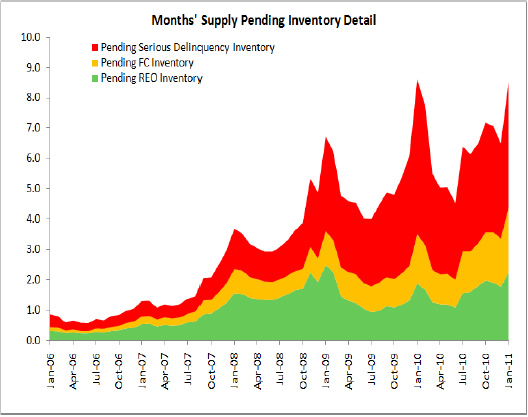

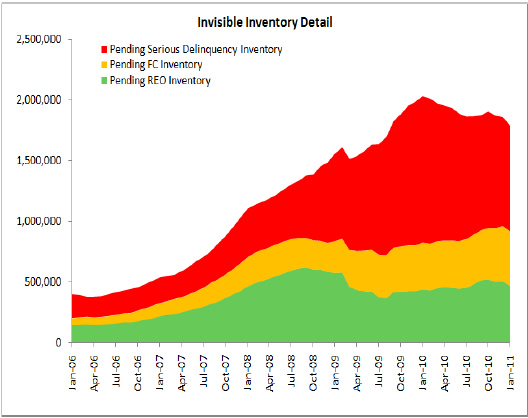

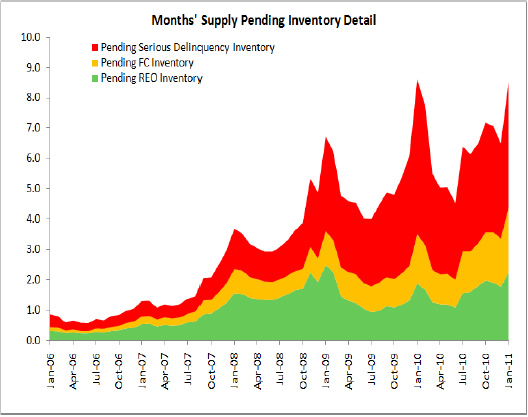

CoreLogic (NYSE: CLGX), a leading provider of consumer, financial and property information and business services, reported today that the current residential shadow inventory as of January 2011 declined to 1.8 million units, representing a nine months’ supply. This is down slightly from 2.0 million units, also a nine months’ supply, from a year ago. CoreLogic research indicates that although a material portion of the shadow inventory can be optimally treated via modification or short sale, only a small share can be effectively remediated from the shadow supply.

CoreLogic estimates current shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLS) that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders. Transition rates of “delinquency to foreclosure” and “foreclosure to REO” are used to identify the currently distressed non-listed properties most likely to become REO properties. Properties that are not yet delinquent but may become delinquent in the future are not included in the estimate of the current shadow inventory. Shadow inventory is typically not included in the official metrics of unsold inventory.

Data Highlights:

- The shadow inventory of residential properties as of January 2011 fell to 1.8 million units, or nine months’ worth of supply, down from 2.0 million, also nine months’ supply from a year ago.

- Of the 1.8-million unit current shadow inventory supply, 870,000 units are seriously delinquent (4.2 months’ supply), 445,000 are in some stage of foreclosure (2.1 months’ supply) and 470,000 are already in REO (2.2 months’ supply).

- For the first time, CoreLogic has examined how loan modifications and short sales could reduce shadow inventory levels. The analysis took into account optimal treatment methods, based on net present value calculations, as well as expected severity and re-default rates for loan modifications and short sales. Based on these factors, loan modifications and short sales could potentially reduce shadow supply by one-half, but low borrower response rates to lender outreach and high modification re-default rates would render the optimal treatment’s impact to be small.

- In addition to the current shadow inventory supply, there are nearly 2 million current negative equity loans that are more than 50 percent “upside down” that will likely become shadow supply in the near future.

- The highest levels of distressed months’ supply, which is the ratio of the number of properties that are 90 days or more delinquent to the number of home sales, are in New Jersey, Illinois and Maryland. The driving force behind these states with the highest distressed supply is a combination of higher than average 90+ day delinquencies and lower sales activity. The states with the lowest distressed months’ supply are where the boom/bust did not occur and include North Dakota, Alaska and Wyoming. The largest state with the lowest level of distressed months’ supply was Texas.

Mark Fleming, chief economist for CoreLogic commented, “While the trend of the shadow inventory is improving somewhat, the current level and distressed months’ supply remain very high. The short-term weakness in prices and longer-term weakness in the drivers that affect the housing market imply that excess supply will remain high for an extended period of time.”

|

|

| © 2006 - 2022. All Rights Reserved. |

|

|

|