|

Go Back

New Foreclosures Rose 3.5% From Prior Quarter

The Office of the Comptroller of the Currency (OCC) Mortgage Metrics Report for Q4 2019 found new foreclosures rose 3.5% from the prior quarter.

From OCC Mortgage Metrics Report: Fourth Quarter 2019

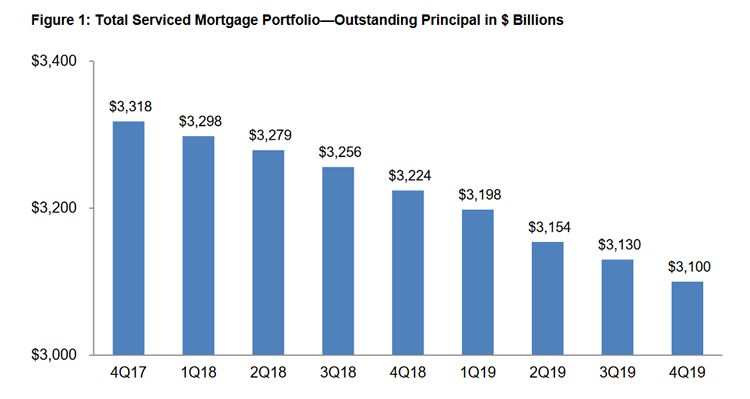

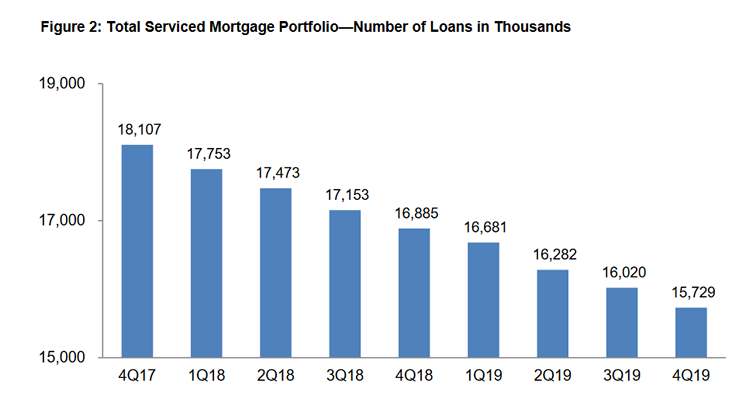

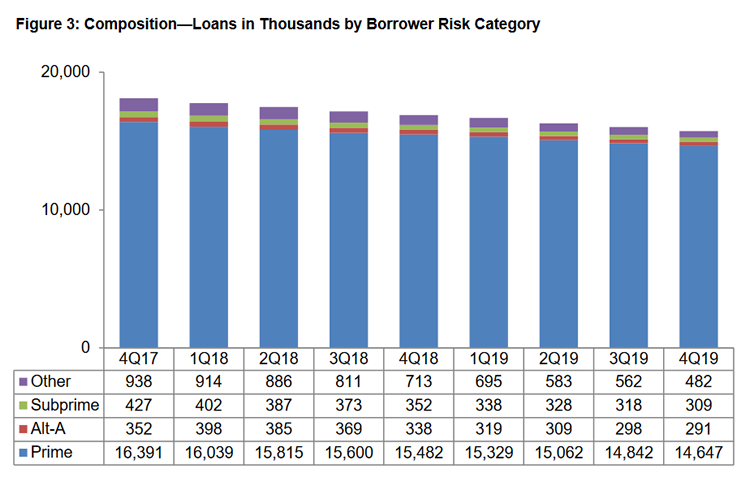

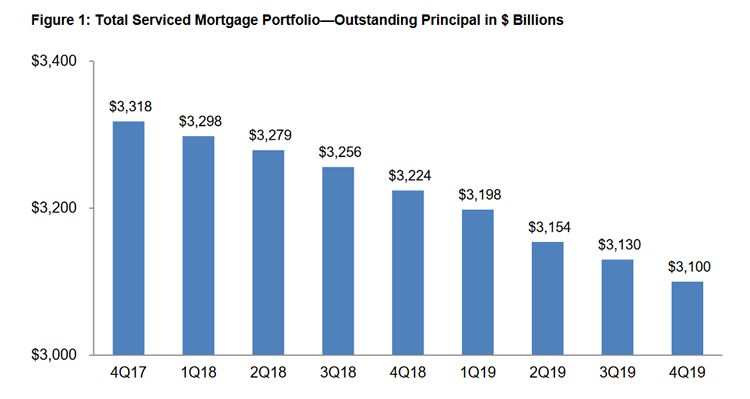

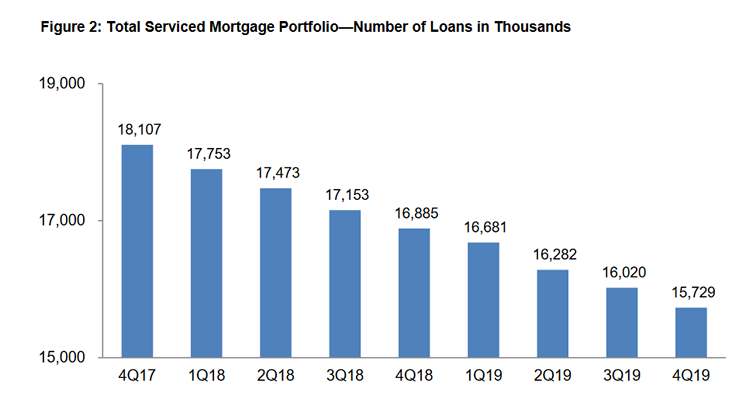

- As of December 31, 2019, the reporting banks serviced approximately 15.7 million first-lien residential mortgage loans with $3.1 trillion in unpaid principal balances. This $3.1 trillion was 29.2 percent of all residential mortgage debt outstanding in the United States.

- The seven national banks are Bank of America, Citibank, HSBC, JPMorgan Chase, PNC, U.S. Bank, and Wells Fargo.

- The overall performance of mortgages this quarter improved slightly from a year ago. The percentage of mortgages that were current and performing at the end of the fourth quarter of 2019 was 96.5 percent compared with 95.8 percent the previous year.

- Servicers initiated 22,248 new foreclosures in the fourth quarter of 2019, an increase of 3.5 percent from the previous quarter and a decrease of 24.6 percent from a year earlier. Home forfeiture actions during the quarter—completed foreclosure sales, short sales, and deed-in-lieu-of-foreclosure actions—decreased 31.5 percent from a year earlier to 9,940.

|

|

| © 2006 - 2022. All Rights Reserved. |

|

|

|