|

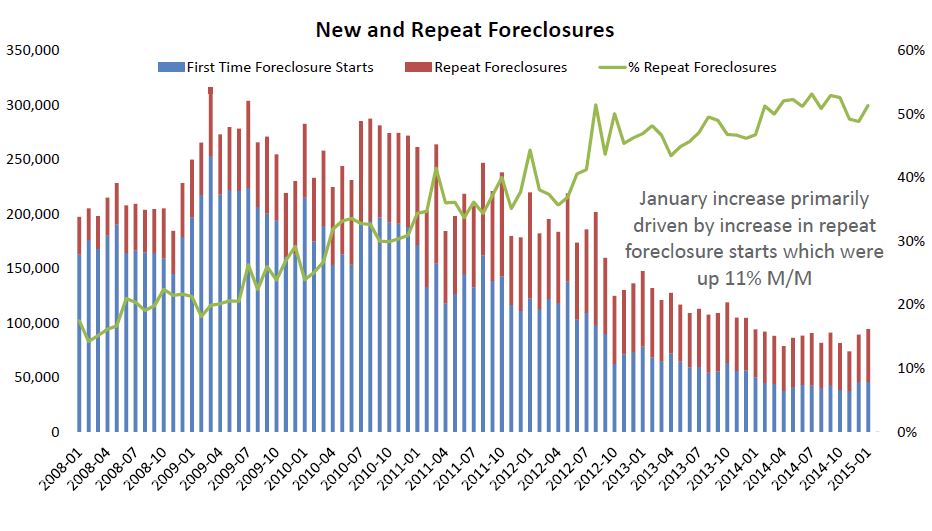

First Time and Repeat Foreclosure Starts at 12-Month High In its closer examination of January foreclosure data Black Knight said there was clear separation in the levels of increase by first time and repeat foreclosure starts in reaching their 12-month highs. There was also a continuation of the differences seen across multiple foreclosure indicators between judicial and non-judicial states.

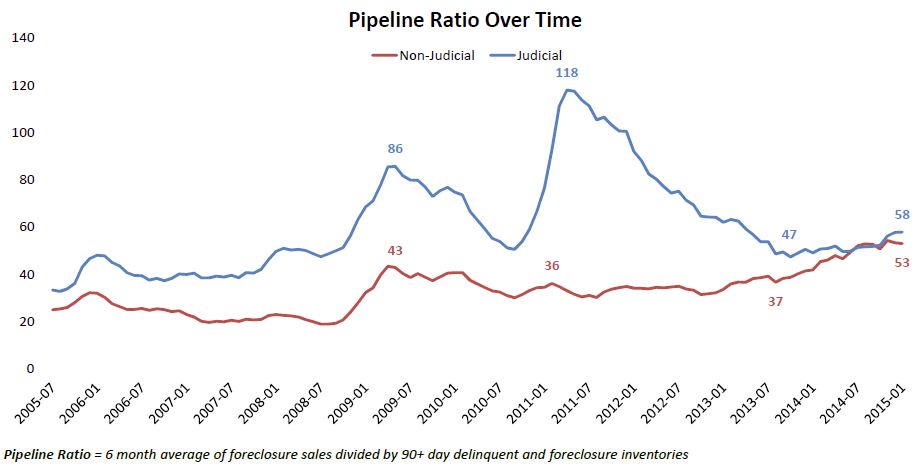

Trey Barnes, Black Knight's senior vice president of Loan Data Products said, "Repeat foreclosure starts made up 51 percent of all foreclosure starts and increased 11 percent from December. In contrast, first-time foreclosure starts were up just a fraction of a percent from the month prior. Similarly, Black Knight found that January foreclosure starts jumped about 10 percent from December in judicial states as compared to just a 1.7 percent increase in non-judicial states. Judicial states are also seeing higher levels of both new problem loans and serious delinquencies (loans 90 or more days delinquent, but not yet in foreclosure) than non-judicial states, although volumes are down overall in both categories." Foreclosure sales or completed foreclosures however have been dropping more rapidly than the inventory of seriously delinquent loans in both judicial and non-judicial jurisdictions leading to increases in foreclosure pipeline ratios. These ratios, representing the backlog in months of foreclosure and 90-day delinquency inventory based on foreclosure sales rates, have been increasing across the board. Barnes said the pipeline now stands at 58 months in judicial states, up from 47 months in 2013 but "a far cry from its high of 118 months a couple of years before that." The non-judicial pipeline has risen to 53 months, close to an all-time high, in recent months. "Throughout the housing crisis," he said, "non-judicial pipeline ratios were significantly lower than those in judicial states."

Black Knight said that January data also showed the impact of anti-dual-tracking legislation which prohibits the simultaneous pursuit of loan modifications and foreclosures. After this legislation went into effect the average months of delinquency for first-time foreclosure starts shot up from 6.5 months to 14.6 months and last year there were virtually no starts on loans less than 120 days delinquent.

|

| © 2006 - 2022. All Rights Reserved. |