|

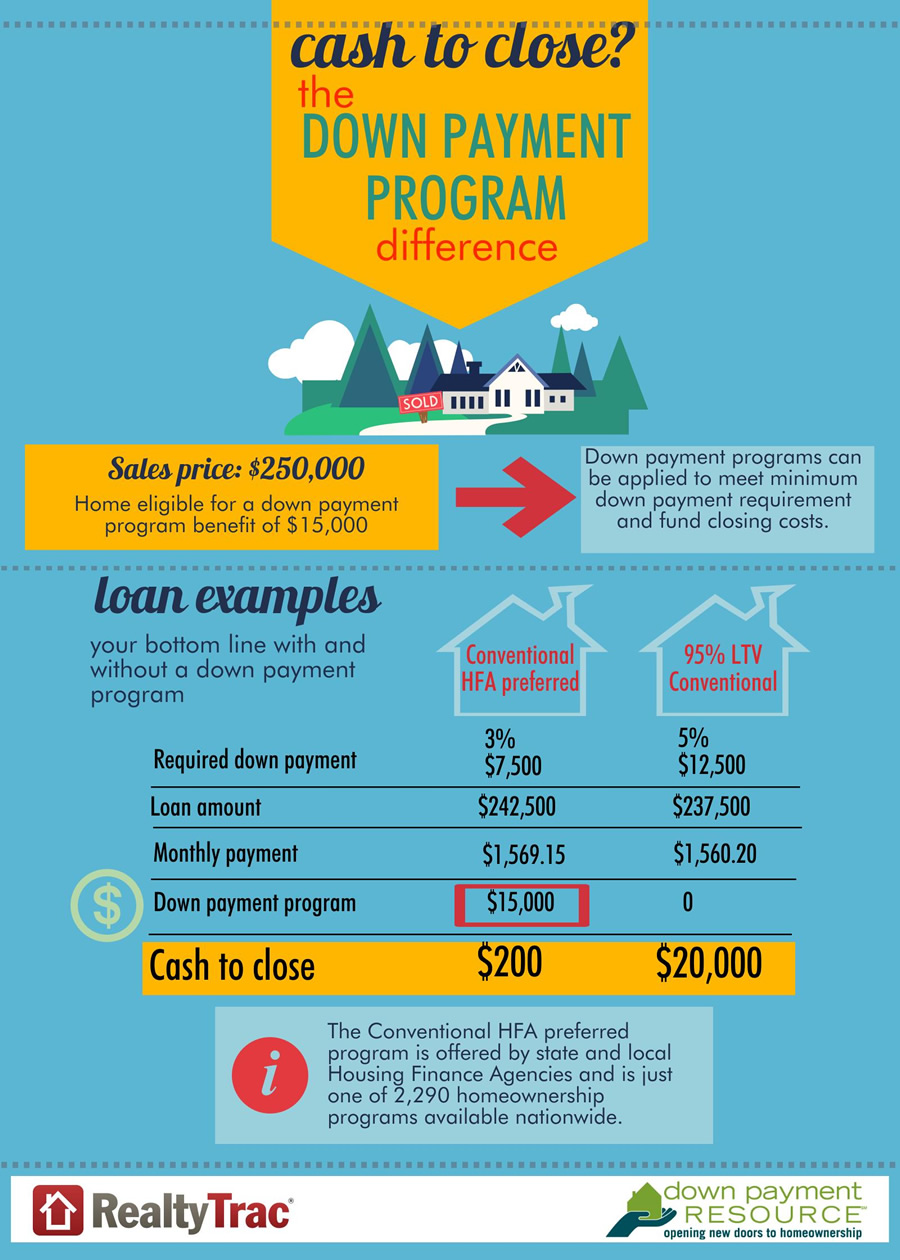

87% of Properties Qualify for Down Payment Assistance A joint analysis by RealtyTrac and Down Payment Resource shows that 87% of homes and condos would qualify for down payment assistance. For the report, RealtyTrac looked at 2,290 down payment programs from Down Payment Resource’s Homeownership Program Index and found out of more than 78 million U.S. single family homes and condos, more than 68 million would qualify for a down payment program available in the county where they are located based on the maximum price requirements for those programs and the estimated value of the properties. The average amount of down payment assistance across all counties is $11,565. “Many homebuyers, especially millennials, haven’t fully investigated their home financing options because are pessimistic about qualifying for a mortgage. Our Homeownership Program Index highlights the wide range and availability of down payment programs available to today’s homebuyers. In fact, 91 percent of the 2,290 programs in our registry have funds available to lend to eligible buyers. Plus, income limits vary depending on the market and programs extend beyond just first-time homebuyers,” said Rob Chrane, president and CEO of Down Payment Resource. “It’s important for buyers to research down payment programs as part of their loan shopping process." At least one down payment program is available in all 3,143 U.S. counties, and more than 2,000 counties have more than 10 down payment programs available to prospective homebuyers. More than half of programs, 54%, are Community Seconds, a second mortgage issued by one of the Housing Financing Agencies or nonprofit organization with a very low or no interest rate. The payment on the second mortgage may be deferred or forgiven incrementally for each year the buyer remains in the home. In a typical scenario this could reduce the amount of cash needed to close from $20,000 to $200. “Historically low homeownership rates across nearly every age demographic have led to a public policy push to lower the barrier to homeownership through down payments as low as 3 percent, but the fact is that the barrier to homeownership is often much lower than even that 3 percent for borrowers who take advantage of one of the myriad down payment help programs available across the country,” said Daren Blomquist, vice president at RealtyTrac. “Prospective buyers — or their agents — willing to put in a few minutes of time to find out what programs are available to them will put themselves in a much better position to successfully purchase a home.”

For a heat map showing DPA coverage, click here.

|

| © 2006 - 2022. All Rights Reserved. |